The link between insurance and mortgages

Insuring to value is a fundamental principle in insurance that ensures your policy will adequately protect your assets and financial investment.

Insurance is that safety net to help condominium associations and homeowners rebuild after a loss or a natural disaster. To rebuild the property to its condition before the loss occurred, the property will need to be insured for its replacement cost.

The replacement cost valuation should take into consideration the current cost of labor and materials and, in some cases, even budget for a little extra cushion for demand surge when the demand and cost for labor and materials spike after an area-wide disaster.

A best practice for condominium associations (AOAOs) would be to obtain a replacement cost appraisal every 3 to 5 years from a qualified and licensed appraiser.

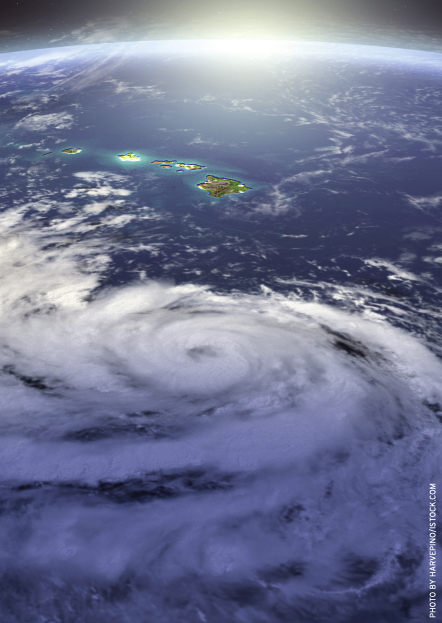

Here in Hawai‘i, an emerging issue that many AOAO boards are now facing is the lack of affordability and availability of hurricane insurance. Due to the limited number of insurers that are still writing property insurance for condominiums, these insurers are assuming a very large portion of the risk should a hurricane make landfall and cause property damage in Hawaiʻi.

With the aggregation of these risks, combined with large claim payouts from other perils such as fire and water damage, some insurers have stopped writing property insurance for condominiums, and one insurer has started to limit their hurricane coverage and are only offering limits at a fraction of the overall replacement cost of the building.

For example, a building with a total replacement cost value of $300 million may only have $25 million limits for hurricane coverage. There are additional hurricane limits available from the excess and surplus lines insurance market; however, the premiums for these additional coverage limits are very expensive.

To understand the importance of this coverage, we need to understand the peril. Hurricanes are one of the major catastrophic perils in Hawaiʻi. For 2023, the National Oceanic and Atmospheric Administration (NOAA) predicts a 50 percent greater chance of above-normal tropical cyclone activity in the central Pacific than usual, due to it being an El Niño summer which typically contributes to an increase in tropical cyclone activity across the Pacific Ocean basin.

Other hurricane-vulnerable states like Florida and South Carolina are already feeling the impact of the unintended consequences from the lack of availability and affordability of hurricane insurance. These states are experiencing restrictions in obtaining financing for condominium unit owners. We are starting to see this trend in Hawaiʻi.

Recently, some lenders have started to issue internal memos to their loan officers with a list of buildings that may be ineligible for traditional financing since these buildings are carrying lower hurricane limits than the replacement cost value of the building. Banks will scrutinize the insurance coverages to ensure it meets lender guidelines to avoid any mid-escrow headaches that will prevent a loan from closing.

Why is this important? Banks customarily package loans to sell to Fannie Mae. Fannie Mae requires the master property policy for AOAOs to be written on a special coverage form including coverage for named storms or hurricanes at full replacement cost. Furthermore, it requires that if a master property insurance policy excludes or limits coverage on any of the required perils, the AOAO must obtain an acceptable stand-alone property insurance policy which provides adequate coverage for the limited or excluded peril. If AOAOs do not meet these requirements, loans in these condominiums are deemed undesirable.

AOAO boards are tasked with the important responsibility of acting in the best interest of their association to ensure financial stability, smooth operation and maintenance of their community. This is their duty to their community and their fellow owners. The board must engage in strategic planning and work with their legal counsel, insurance professional, property manager and even banking professionals to determine if their decision to purchase hurricane coverage limits at less than the replacement cost will ultimately impact the ability of the unit owners to sell or refinance their units.

Elaine Panlilio, CRM, CIC, CISR is the AOAO unit manager at Atlas Insurance Agency, the largest locally owned insurance agency in Hawaiʻi. Panlilio has 17 years of insurance experience and holds the Certified Risk Manager, Certified Insurance Counselor and Certified Insurance Service Representative professional designations from the National Alliance for Insurance Education and Research. She is a member of the CAI Legislative Action Committee and the State of Hawaii DCCA Condominium Task Force. (808) 533-8766, epanlilio@atlasinsurance.com. www.atlasinsurance.com