In the aftermath of the Florida tragedy, many associations are checking their policies

The tragic collapse of the Champlain Towers South in Florida has caused many condo associations to ask whether their policies would provide coverage in the event of this type of event.

Let’s take a closer look at “collapse” from an insurance standpoint and how it is defi ned in the standard Commercial Property insurance (Property) policy. The Property policy covers a building for direct physical damage caused by “Covered Causes of Loss.”

There are several factors that come into play in the event of a catastrophic loss, such as a building collapsing: What caused the building to collapse? Was it a “covered cause of loss?” Was coverage in force at the time of loss?

Under the Property policy, collapse coverage is excluded. The Property policy is a standard form used nationally, but the wording varies by carrier. The standard Property policy states under Exclusions: “We will not pay for loss or damage caused directly or indirectly by any of the following … Collapse, including … (1) An abrupt falling down or caving in; (2) Loss of structural integrity; (3) Any cracking, bulging, sagging, bending, leaning, settling, shrinkage or expansion.”

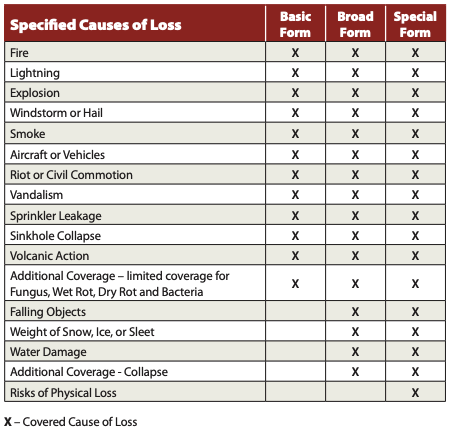

Coverage, however, is given back and the policy will pay “if collapse results in a Covered Cause of Loss.” So what exactly are the “Covered Causes of Loss?” An insurance company will off er Property coverage under three types of forms:

- Basic Form covers “fi re, lightning, explosion, windstorm or hail, smoke, aircraft or vehicles, riot or civil commotion, vandalism, sprinkler leakage, sinkhole collapse, volcanic action, and additional-limited coverage for fungus, wet rot, dry rot and bacteria.” In the basic form, the collapse would have to be caused by fi re, windstorm, etc. Therefore, if a building should suff er signifi cant windstorm damage and the building should collapse, there is coverage.

- Broad Form covers causes of loss listed in the Basic Form plus “falling objects, weight of snow, ice, or sleet, water damage, and additional coverage—collapse.” The collapse would have to be caused by perils listed in the Basic Form and will include collapse from weight of snow, ice, sleet or even weight of water build-up. Again, the collapse will have to occur from a “Covered Cause of Loss.”

- Special Form covers causes of loss listed in the Broad Form plus “risks of physical loss.” This is the broadest of the three forms and is basically an AllRisk form except for exclusions. Therefore, the peril of Collapse could be insured as long as there is no exclusion that caused the collapse.

The following chart provides a sideby-side comparison of the three forms:

One possible cause of a building collapse is “Sinkhole Collapse,” which is listed on all three forms. The Property policy defines Sinkhole Collapse as “sudden sinking or collapse of land into underground empty spaces.” What if the building collapses from the top and does not go into underground empty spaces? “Additional Coverage-Collapse” is included under both the Broad and Special Forms and is defined as “an abrupt falling down … of a building with the result that the building or part of the building cannot be occupied for its intended purpose.”

The Additional Coverage-Collapse endorsement states that the policy “will pay for direct physical loss … if such collapse is caused by … a. building decay (unless there is prior knowledge); b. insect or vermin damage (unless there is prior knowledge); c. use of defective materials in construction, remodeling or renovation if the abrupt collapse occurs during the course of construction, remodeling or renovation; d. use of defective material in construction, remodeling or renovation if the abrupt collapse occurs after … only if the collapse is caused by: (1) building decay or insect or vermin damage; (2) one or more of the ‘specified causes of loss’; (3) breakage of building glass; (4) weight of people or personal property; or (5) weight of rain that collects on a roof.”

The Additional Coverage-Collapse does not apply to a “building or any part of a building that is in danger of falling down or caving in; a part of a building that is standing, even if it has separated from another part of the building; or a building that is standing or any part of a building that is standing, even if it shows evidence of cracking, bulging, sagging, bending, leaning, settling, shrinkage or expansion.”

With regard to the collapse of the Florida condominium, coverage is still under investigation. If the coverage is under the Basic Form, collapse would not be covered. If the coverage is under the Broad Form, collapse coverage is uncertain and probably not covered. Under the Special Form, coverage could exist, but there are exclusions from wear-and-tear. Based upon what little information we have available, the association knew there were issues with rusting, spalling and corrosion, which are wearand-tear issues.

So let’s say that there was coverage and the policy responded to insuring a building that collapsed, the policy pays up to the building limit shown, subject to the deductible and coinsurance penalty, if any. Coinsurance is “the clause that states the Insured will share in losses to the extent that he/ she is underinsured at the time of loss.”

Building Ordinance or Law: What role does it play?

Who pays for the cost to remove the debris or the cost to demolish the damaged and undamaged portions of the building? To rebuild the building, will there be increased costs of construction to meet current building code requirements?

Building Ordinance or Law, if purchased by the policyholder, would pay for debris removal, demolition costs and increased costs of construction to meet current building code requirements up to the policy limits.

Association’s deductible: Who pays it?

In Hawaii, by statute the association’s deductible can be assessed to the unit owners. In a catastrophic event such as a collapsed building, the board can assess the association’s deductible to all the unit owners. Most HO-6 policies have a minimum limit of $1,000 for loss assessment coverage.

It is always recommended that unit owners discuss coverage limits with their insurance agents so they have a good understanding of how their policies would respond in the event of a catastrophic event.

Della Nakamoto is an account executive with the AOAO Group at Atlas Insurance Agency, A Marsh & McLennan Agency LLC. She has over 24 years’ experience in the insurance industry, 13 with Atlas. Her fields of expertise are commercial and residential condominium associations and small, medium and large businesses. (808) 244-5561 or dnakamoto@atlasinsurance.com